WHAT IS DE-ENVELOPING?

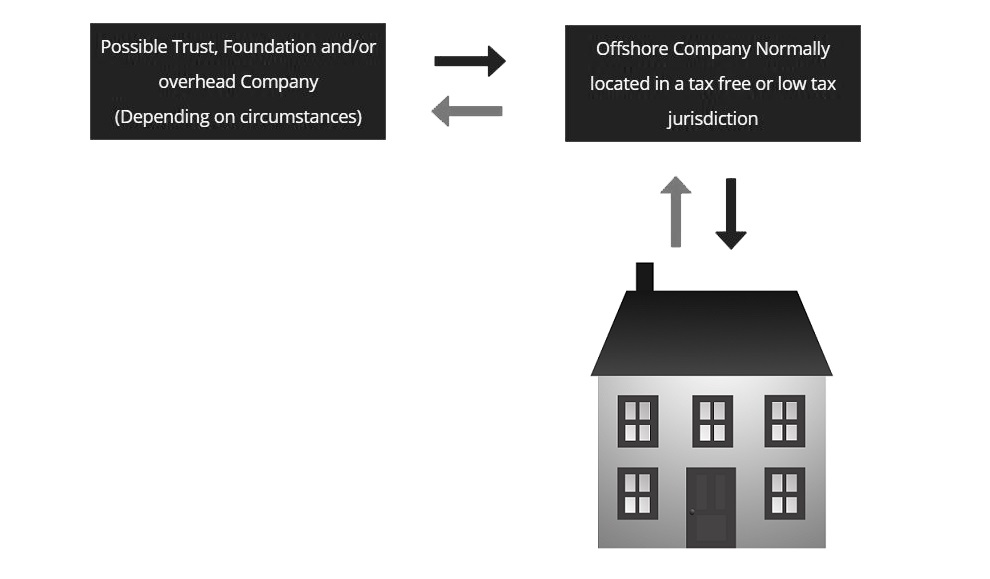

In simple terms, de-enveloping a property is when an individual, trust or otherwise decide to directly own a property rather than own it through a corporate vehicle normally registered in a tax free or low tax jurisdiction. The use of what are colloquially called ‘offshore’ companies to own both residential and commercial properties in the UK (primarily in or around the London area) started many decades ago due to the then significant tax advantages available to non-domiciled individuals whether they were or were not ordinarily resident in the UK.

Without becoming too technical or discussing the cumulative changes to UK legislation (primarily over the last decade) the ‘historic’ tax benefits of using an offshore company were extremely attractive for both the non-domiciled UK based community and foreign based investors wishing to purchase UK property. The advantages of using an offshore company could (depending on specific circumstances) include:

- The legal avoidance of capital gains tax on the sale of the property;

- The legal avoidance of stamp duty land tax (SDLT) where shares in the offshore company were exchanged by suitably qualified individuals;

- The legal avoidance (were pertinent) of inheritance taxes (IHT)

- Asset protection from 3rd party litigation

In short, there is no doubt that the UK was until relatively recently an extremely attractive place for the international wealthy to both invest and live in with the UK’s traditionally very lenient and attractive tax treatment of non-doms having played no small part in making London the natural habitat of the world’s mega-wealthy. At the time of writing, July 2017, there still remain certain tax benefits for the international wealthy but it is certain that these remnants from more ‘tax friendly’ times will be whittled away until extinct probably within the next 5 years.

PRIORITY ENQUIRY FORM

(Strictly Confidential No Obligation)

A FULL RANGE OF PROPERTY DE-ENVELOPING, ACCOUNTANCY & TAX PLANNING SERVICES

De-enveloping.co.uk is part of The SCF Group of Companies and has been specifically set-up to assist those who have purchased London and UK properties using previously tax efficient offshore or international business companies but now find that the annual Advanced Tax on Enveloped Dwellings (ATED) is too high to economically maintain on properties worth over £500,000.00 AND do not want to be subject to Stamp Duty Land Tax (SDLT) when transferring a company held property to themselves.

It should be noted that generally it is not economically viable to de-envelope properties below £750,000.00 but as the ATED tax thresholds are very punitive it becomes almost compulsory (where possible) for properties worth over £1,000,000.00 with very substantial savings coming into play for properties worth over £2,000,000.00.

The services offered by The SCF Group combine almost 25 years of offshore and tax planning experience which enable the firm to correctly prepare, amend, legalize or otherwise prepare a company for tax free conveyancing in conjunction with our specialist conveyancing solicitors. For those with properties worth £2 million or more the cost of de-enveloping is often less than 1 year’s ATED Tax.

It should be noted that not all properties can be de-enveloped including properties that have received 3rd party funding or are subject to encumbrances. In addition, generally commercial properties are exempt from ATED as are those that are carrying out genuine UK property management services, which for the purposes of clarification does not simply mean renting out a property using a UK estate agent but actually carrying out property management in the UK with profits subject to UK corporate and value added taxes.

ACCOUNTANCY & TAX PLANNING

In addition to property de-enveloping services The SCF Group also provides a wide range of tax planning, accountancy and company formation services both within the UK and internationally including wealth protection trusts and private interest foundations. For more information on the main SCF Group please go to our ‘Mother’ Website www.scfgroup.com.